Table Of Content

- $150$250 not $150 $250 Statement Credit

- Chase Freedom Unlimited - Card Redesign?

- If I use my Disney® Visa® Card outside the U.S., do I have to pay any foreign transaction fees?

- Chase joins Make-A-Wish® as a National Corporate Partner to Grant Travel Wishes For Children Facing Critical Illness

- How the Delta Variant has affected the Disney Parks

- Disney Cinderella’s Castle debit card

- Disney, Chase and Visa Announce Multi-Year Extension of Disney® Visa® Card Programs

To receive a merchandise discount, you must mention the specific offer. For entry into the Disney or Star Wars Cardmember Photo Opportunities, you must present your valid Disney Visa Card. Not valid in combination with other offers, discounts, promotions or with any previous purchase.

$150$250 not $150 $250 Statement Credit

(This means that financing equipment with Affirm will not result in extra points.) Apparel and app memberships also aren't eligible. From Feb. 1, 2023, through March 31, 2025, holders of the Chase Sapphire Reserve® can earn 10 points per dollar spent on eligible Peloton purchases, up to a maximum of 50,000 points. CreditCards.com is an independent, advertising-supported comparison service.

Chase Freedom Unlimited - Card Redesign?

"Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with a Chase Private Client Banker at your nearest Chase branch to learn about eligibility requirements and all available benefits. Whether you choose to work with a financial advisor and develop a financial strategy or invest online, J.P.

If I use my Disney® Visa® Card outside the U.S., do I have to pay any foreign transaction fees?

Minimum purchase and/or separate Theme Park admission and Theme Park reservation may be required. Offers are for personal use only and may not be transferred or resold. Chase is not responsible or liable for fulfillment of these Disney Theme Park and Resort perks. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Cardholders earn a base rate of an unlimited 1.5% cash back on every purchase, making it an ideal option for expenses not covered by the Sapphire Preferred. The card also offers 3% cash back on drugstore purchases, helping you maximize rewards on even more purchases. You can convert the 1.5% and 3% cash back to 1 and 3 Ultimate Rewards points per dollar spent, respectively. With the Chase Slate Edge, you are automatically considered for a 2% APR reduction if you pay your monthly bill on time and spend at least $1,000 on the card before your next account anniversary (terms apply). While you'll want a plan to pay off your balance transfer before the interest kicks in, this feature can help you lower your APR compared to what you might pay with other credit cards.

How the Delta Variant has affected the Disney Parks

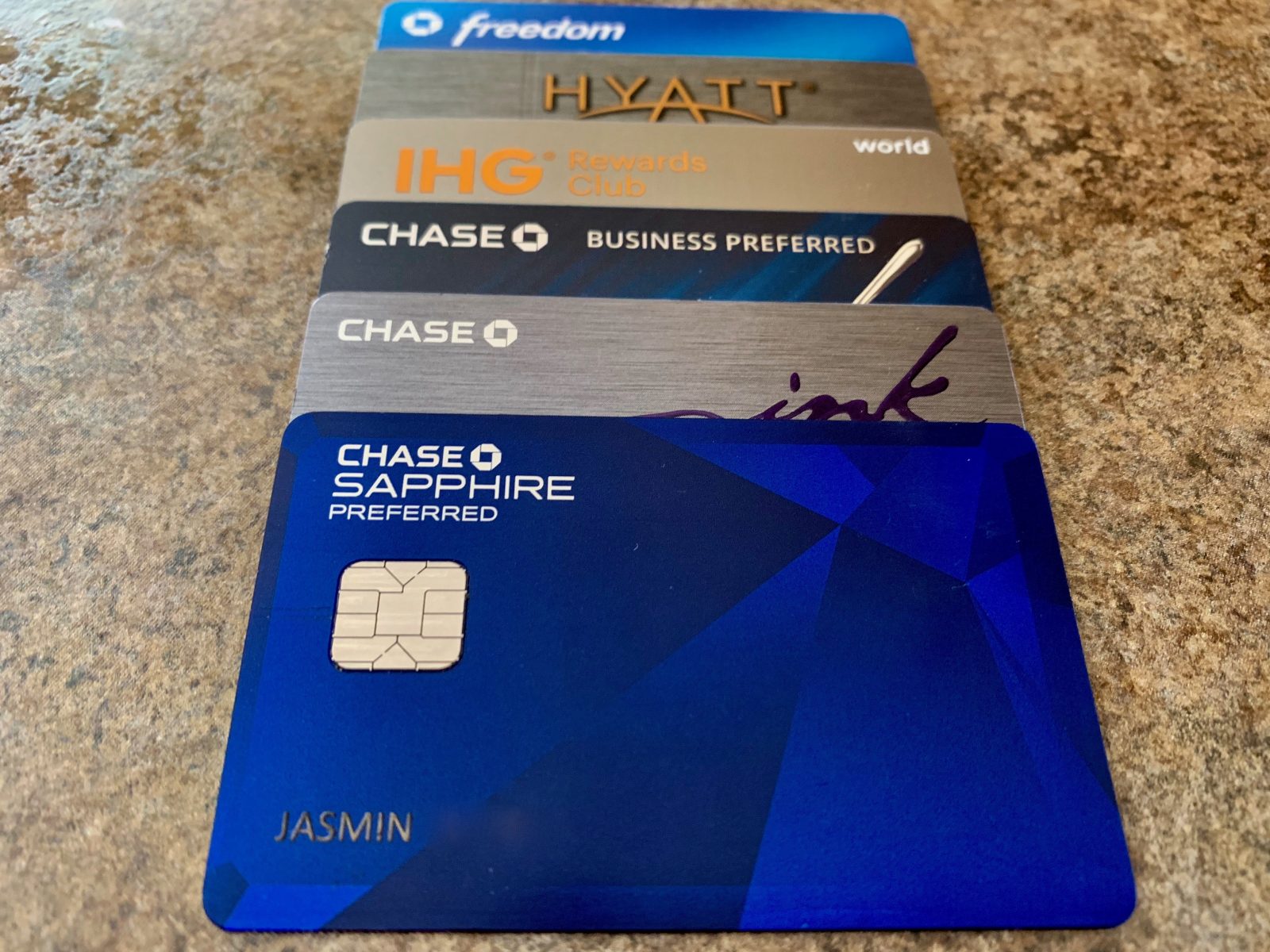

Chase cards that are co-branded with travel providers or other businesses also have that company’s logo on them. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A.

Chase and Amazon Announce New Benefits and Features on the Amazon Visa Card Portfolio - Business Wire

Chase and Amazon Announce New Benefits and Features on the Amazon Visa Card Portfolio.

Posted: Mon, 01 May 2023 07:00:00 GMT [source]

Disney Cinderella’s Castle debit card

If you're interested in paying less interest, these are some of the best offers available. When you're in credit card debt, your primary focus should be repayment, not earning rewards, but the fact that some of the cards on this list earn rewards is a nice bonus. Must use your valid Disney Visa Card and/or Disney Rewards Redemption Card as form(s) of payment at the time of purchase for full amount of purchase to receive special offers.

Disney, Chase and Visa Announce Multi-Year Extension of Disney® Visa® Card Programs

With the Disney debit cards, it’s not just about getting a custom design to showcase your Disney loyalty, either. Take the Disney® Visa® Personality Quiz to find out which credit card design is your perfect match. You can have both an American Express® Gold Card and Chase Sapphire Preferred. Since many of their category bonuses overlap, it might not be the best pairing. However, it could be worthwhile if you want to diversify your rewards and are willing to pay $250 for an Amex Gold card (see rates and fees).

You can get these custom cards with the Disney Premier Visa Card and the Disney Visa Card. Chase offers several different types of debit card designs that you can choose from. A balance transfer doesn't directly hurt your credit score and could help improve your credit if you're able to pay down your debt. However, you'll want to keep in mind that your credit score will temporarily dip when you apply for new credit (including a balance transfer card).

While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here's an explanation for how we make money.The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. While the Chase Sapphire Preferred offers bonus points on various spending categories, the Bilt Mastercard® has the notable distinction of earning Bilt Points on rent payments. Earn 1X points on rent paid through the Bilt app or website, with no transaction fee, for up to 100,000 points each calendar year. If you happen to be one of them, combining the Sapphire Preferred with the Bilt Mastercard is an excellent way to earn rewards on every possible dollar spent.

The Chase Freedom Flex℠ is a great card for anyone who enjoys squeezing the most value out of their credit card thanks to its generous rotating quarterly bonus categories. The Chase Freedom Unlimited® is geared toward those who want to earn cash back on their everyday spending and still want access to a helpful intro APR offer. Other benefits of the card were largely unchanged, and the annual fee remained $95.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC. Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. You also won’t be able to customize most of the co-branded credit cards like the Chase Southwest, Marriott, IHG, United, and other similar cards.

No comments:

Post a Comment